Sd Property Tax

Property Tax | South Dakota Department of Revenue

The Property Tax Division is responsible for overseeing South Dakota's property tax system, including property tax assessments, property tax levies and all property tax laws. Property taxes are the primary source of funding for schools, counties, municipalities and other units of local government. The Property Tax Division plays a critical role in ensuring that property assessments are fair, equitable and in compliance with state law.

https://dor.sd.gov/individuals/taxes/property-tax/

Property Tax | South Dakota Department of Revenue

Then the property is equalized to 85% for property tax purposes. If the county is at 100% of full and true value, then the equalization factor (the number to get to 85% of taxable value) would be .85. For example: A home with a full and true value of $230,000 has a taxable value ($230,000 multiplied by .85) of $195,500.

https://dor.sd.gov/businesses/taxes/property-tax/

Treasurer-Tax Collector

The 2021/2022 Annual Secured property tax roll is closed. A search for a prior year, already paid secured property tax bill will result in “no record found’. ... Treasurer-Tax Collector San Diego County Admin. Center 1600 Pacific Hwy, Room 162 San Diego, CA 92101.

https://www.sdttc.com/

Property Tax Services - San Diego County, California

Property Tax Services. Property Tax Services. Rebecca Greene - Manager, Auditor & Controller. 5530 Overland Avenue, Suite 410, San Diego, CA 92123. Phone: (858) 694-2901 | Fax: (858) 694-2922 | MS O-53. Email: [email protected].

https://www.sandiegocounty.gov/content/sdc/auditor/ptspage1.htmlSouth Dakota Property Taxes By County - 2022 - Tax-Rates.org

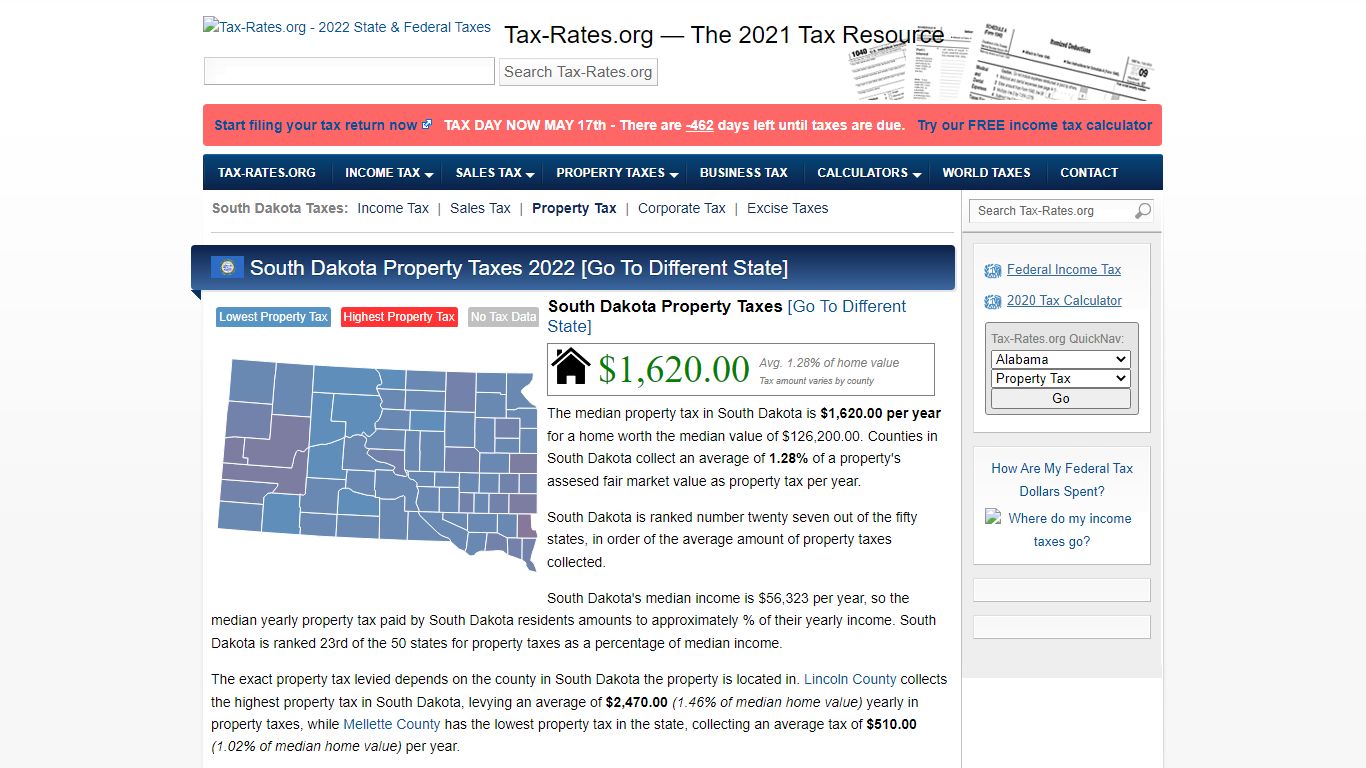

South Dakota Property Taxes [Go To Different State] $1,620.00 Avg. 1.28% of home value Tax amount varies by county The median property tax in South Dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Counties in South Dakota collect an average of 1.28% of a property's assesed fair market value as property tax per year.

https://www.tax-rates.org/south_dakota/property-tax

Taxes | South Dakota Department of Revenue

Everything you need to know about games, licensing and beneficiaries of the South Dakota Lottery. Learn what you need to file, pay and find information on taxes for the general public. See what other South Dakota taxpayers are asking the Department of Revenue. Quick links to help you find the right individual forms fast.

https://dor.sd.gov/businesses/taxes/

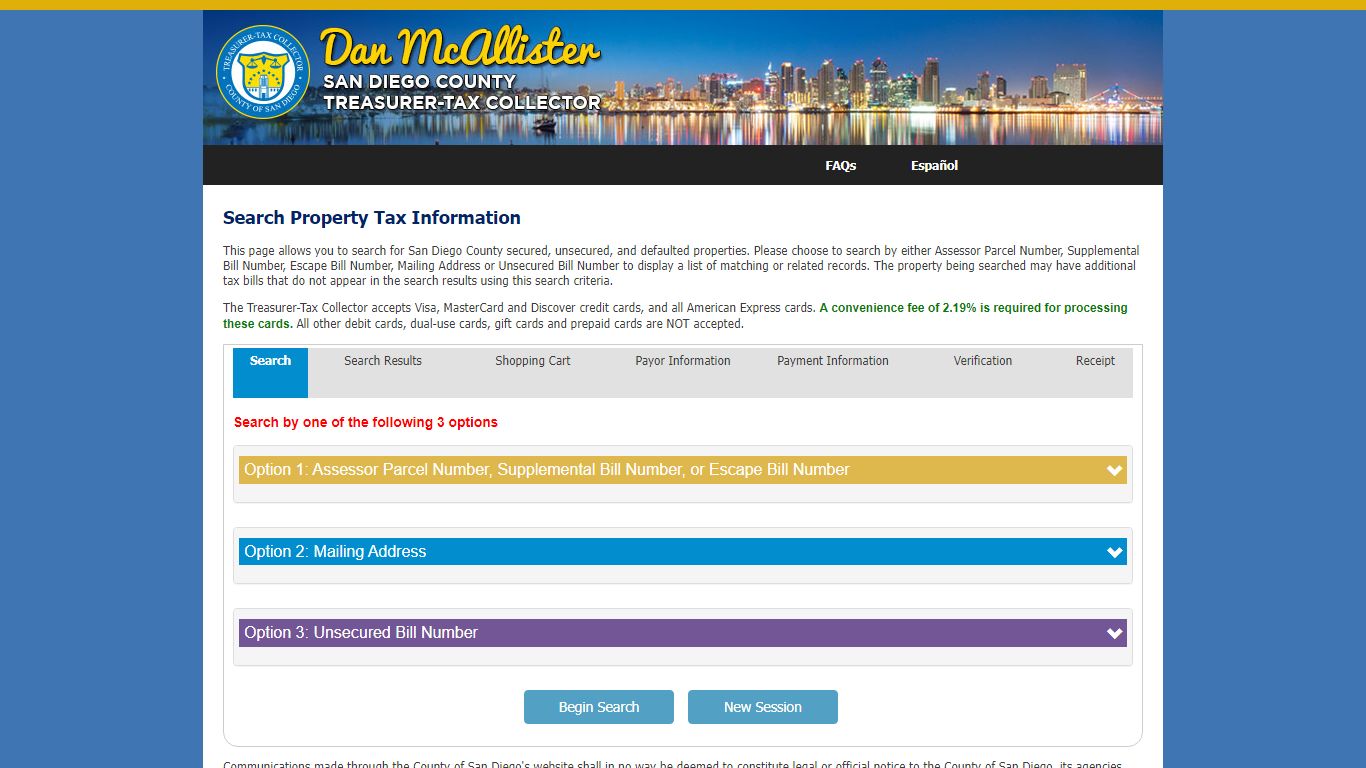

County of San Diego Treasurer - Tax Collector

The Treasurer-Tax Collector accepts Visa, MasterCard and Discover credit cards, and all American Express cards. A convenience fee of 2.19% is required for processing these cards. All other debit cards, dual-use cards, gift cards and prepaid cards are NOT accepted. Search.

https://iwr.sdttc.com/paymentapplication/Search.aspx

Treasurer-Tax Collector

The 2021/2022 Annual Secured property tax roll is closed. A search for a prior year, already paid secured property tax bill will result in “no record found’. ... Treasurer-Tax Collector San Diego County Admin. Center 1600 Pacific Hwy, Room 162 San Diego, CA 92101.

https://www.sdttc.com/index.html

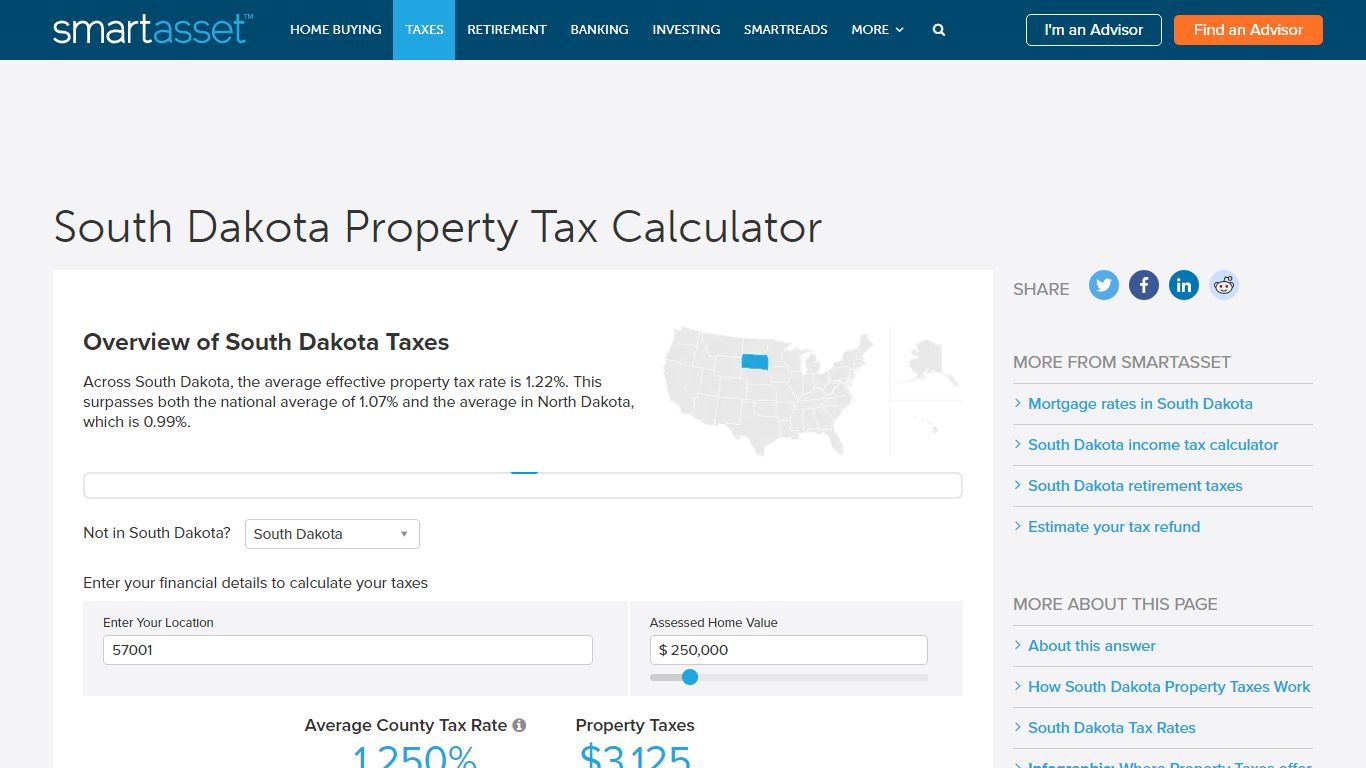

South Dakota Property Tax Calculator - SmartAsset

Overview of South Dakota Taxes. Across South Dakota, the average effective property tax rate is 1.22%. This surpasses both the national average of 1.07% and the average in North Dakota, which is 0.99%.

https://smartasset.com/taxes/south-dakota-property-tax-calculator

Property Tax 101 - South Dakota Department of Revenue

nonagricultural properties for each county. South Dakota laws require the property to be equalized to 85% for property tax purposes. • If the county is at 100% fair market value, the equalization factor is 0.85. • If a county falls below the 85% rule, a factor above 1.0 may be applied. For additional information about your property’s

https://dor.sd.gov/media/oeqheqmi/property-tax-101.pdf